Protect Your Investment With GAP Auto Insurance

Reduce Risk While Enhancing Borrower Experience

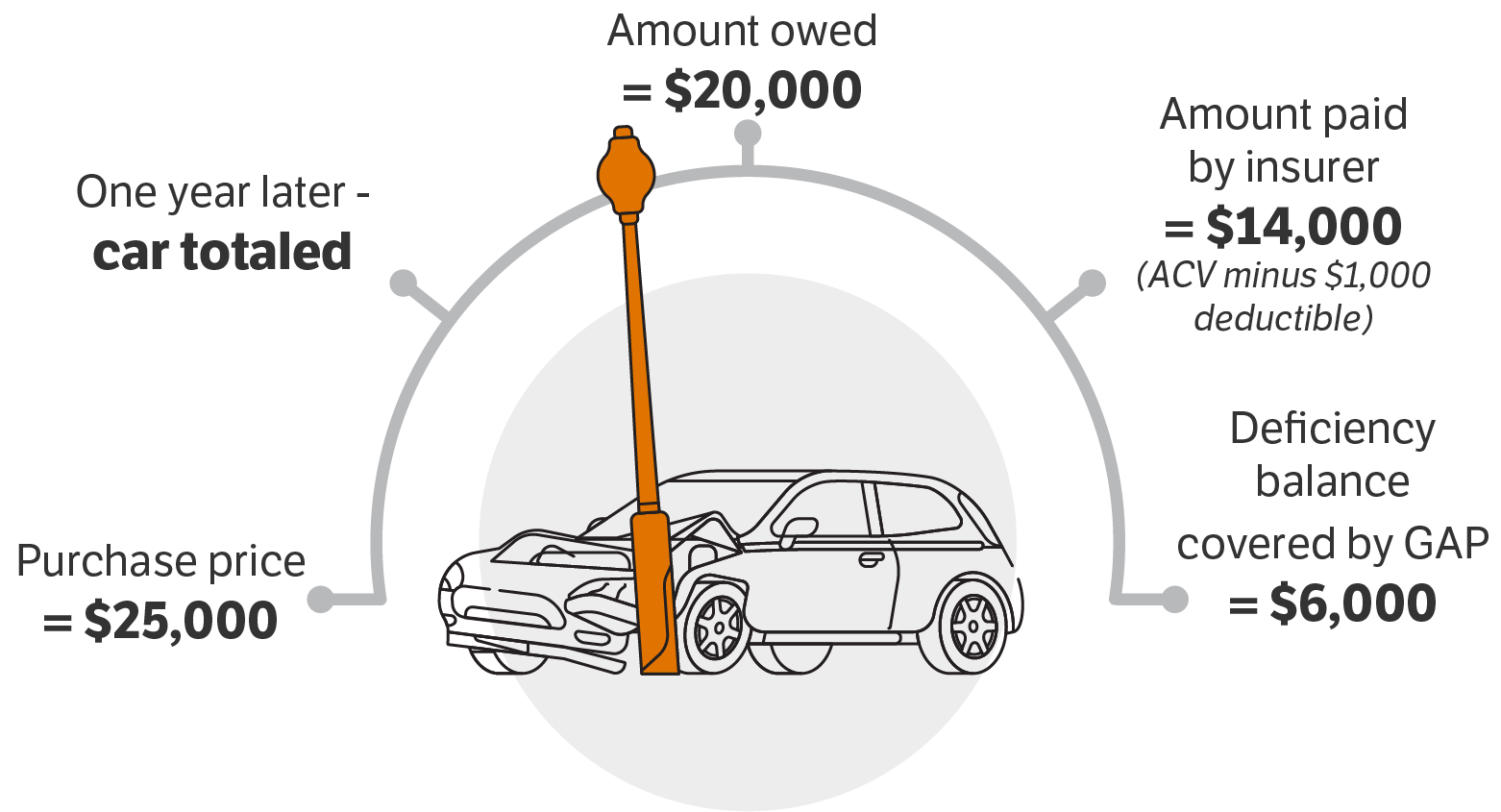

In the unfortunate event of a total loss or theft, don’t let your borrowers face financial strain. Our Guaranteed Asset Protection (GAP) insurance steps in to cover the difference between what primary insurance pays (the Actual Cash Value of the vehicle minus any deductible) and the remaining loan balance at the time of loss.

GAP Protects Both You and Your Borrowers

- New vehicles depreciate faster than loan balances decrease, leaving borrowers vulnerable to significant financial gaps.

- Our customizable GAP programs not only shield your institution from charge-off exposure but also ease your borrowers’ out-of-pocket expenses.

- Strengthen relationships with borrowers by offering comprehensive protection tailored to their needs.

GAP Benefits: More Than Just Protection

- Foster increased borrower loyalty and satisfaction.

- The minimal monthly cost of GAP, when financed into the loan, offers peace of mind without breaking the bank.

- Generate non-interest income while providing essential coverage.

- Extend on a replacement vehicle without including negative equity in the loan

The State National Advantage

- Streamlined claims process through our proprietary system, InsurTrak.

- Submit claims quickly with a one-page form and no supporting documentation required in most cases.

- Experience rapid claim settlements, averaging less than 7 days compared to several weeks with other providers.

- Benefit from comprehensive initial and ongoing training, both onsite and via webinar.

- As the program administrator, underwriter, and claims adjuster, we save you time, money, and effort while ensuring efficiency and accuracy.

Choose The Program That Fits Your Needs

GAP FasTrak

Swift claims processing and flexible coverage options.

-

- Claims paid in 7 days or less.

- Enjoy a 60-day free look period.

- Pro-rata refunds over the term.

- Access to a customizable suite of coverages through our robust sales and administrative platform, InsurTrak.

GAP FasTrak Gold

The ultimate protection with added benefits.

-

- Includes all features of GAP FasTrak.

- GAP Plus offers an additional $1,000 credit towards the replacement vehicle when financed with your institution.

GAP FasTrak Platinum

Unmatched coverage for maximum peace of mind.

-

- Includes all features of GAP FasTrak Gold.

- Auto Deductible Reimbursement covers unlimited insurance deductibles incurred on physical damage losses for up to 4 household vehicles.

- Simplify vehicle option and cost tracking with Monroney Labels ordered directly through InsurTrak.

- Fully customizable with additional coverage/endorsement options available based on your needs

A full range of portfolio protection options.

Contact us to learn more about:

Collateral Protection Insurance (CPI) – Our solution is built on advanced technology and customer support that minimize the impact on your borrowers and your staff like no other provider. With more than 50 years of experience, innovation, and commitment, State National is the proven leader in CPI. Today, you can turn to us for the industry’s broadest protection for you auto portfolio’s bottom line.

Claims Advocacy Skip Recovery (CARS) – This combination of Skip Tracing, Repossession, Remarketing, and Outside Insurance Claims Advocacy mitigates losses, reduces internal expenses, and takes the workload off the lender’s staff. CARS is offered in connection with our portfolio protection programs at a reasonable cost. All CARS services are fully integrated with InsurTrak for the ultimate in transparency at every stage of the process.

Add1 Total Protection (Add1) – Protection from total losses with less risk of default. An industry first, Add1 offers a whole new level of flexibility in an affordable, easy-to-administer program from protection against total losses. Place just one policy, then collect from customers and pay us monthly. By covering only total losses, you keep premiums low and minimize the risk profile impact of your borrowers, helping to reduce delinquencies. The program requires no changes to your servicing system while providing complete insurance tracking, reporting, and customer service.

Post Paid Protection (P3) – Monitor borrower insurance status, encourage borrower compliance, and reduce charge-offs. Lower premiums offer cost-effective protection that is affordable for borrowers and highly collectable by the lender, with no risk to the lender of uncollectable charge-offs. P3 is customizable to meet the risk tolerance of the lender and price point to the borrower, and includes notifications to borrowers. Contact us to learn more about truly unique, fully tracked portfolio protection products designed specifically for subprime lenders.

White Papers

What is Collateral Protection Insurance (CPI) and Does Your CU Need It?

Understanding how CPI works will help you decide if it is the best way to mitigate risk in your credit union.

Download

Portfolio Protection Program Comparison

A No-Nonsense Guide to Choosing the Right Portfolio Protection Program for Your Credit Union

Download