Stellar Member Experience

We know how important your members are. When you partner with us for collateral protection insurance we become an extension of your credit union — and it’s a responsibility we take very seriously. We do everything we can to ensure your members feel respected and well served — because their positive experience with us becomes another positive impression of your credit union.

We conduct annual surveys to gauge our clients’ and their members’ satisfaction, using the results to identify areas for improvements. Our 2024 Customer Satisfaction score (CSat) came in at 97%, with 98.3% of members surveyed reporting that State National was courteous and 99% describing us as informative.

Starting with the very first member touchpoint, our programs are designed to reduce false placements and maximize ease of use and satisfaction.

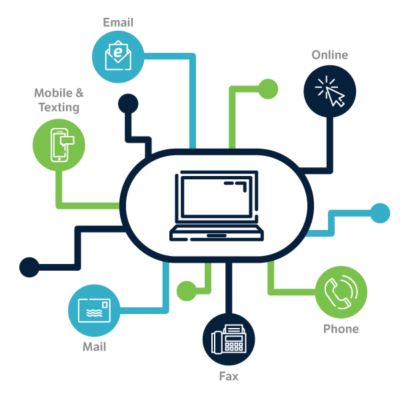

Our welcome letter, which is unique to State National, is a friendly notification sent before the first notice on new auto loans to explain insurance requirements. Paired with our custom and proprietary technology solutions, all notifications provide members multiple options to submit insurance.

You also get your own dedicated P.O. Box and toll-free 800 number with a custom phone greeting of your choice. These exclusive features allow us to process information faster and provide a more personalized and seamless experience for your members.

Insurance Submission Options

One-Call Resolution

Your members don’t want to spend their time making multiple phone calls — and you don’t want them encountering frustration in the verification process, because that means noise for you. We strive for one-call resolution, placing outbound verification calls to the member’s agent or insurance carrier while they’re on the phone, eliminating callbacks and unnecessary follow-ups.