Technology Drives Efficiency

Some companies are change averse and slow to adopt new innovations. For them, “good enough” is good enough. But that’s not good enough for us — and it’s definitely not good enough for you or your borrowers.

State National was the industry pioneer in tracking technology, and we remain the high-tech leader in the field. If we can’t find the best technology for the job, we create it ourselves. We’re always relentlessly searching for new ways to streamline our operations and provide ease of use for our clients, and we constantly have our eye out for emerging technology solutions that will make us better able to help your financial institution grow and thrive.

Our extensive and proactive automated processes drive efficiency, ease of use, and better results. Because innovation is our mindset, our services and products are simply better.

InsurTrak – Everything you need to manage your portfolio protection insurance program for both auto and mortgage — all found in one system. InsurTrak, our exclusive loan tracking system, is your one source for administering a collateral protection insurance program. This powerful, one-of-a-kind proprietary platform includes a comprehensive set of web-based tools for your staff.

Fast, private, and available anytime, InsurTrak allows for program management and performance with extensive on-demand reporting. You get real-time access to the most current insurance information on your loan portfolio and InsurTrak also offers comprehensive claims management, multiple reports, and videos for online training.

In addition, you’ll experience the fastest and easiest claim-filing process in the industry, requiring no paperwork for most claims. Simply file a claim and we’ll process it for all applicable coverages — and ensure prompt payment — all through InsurTrak Online.

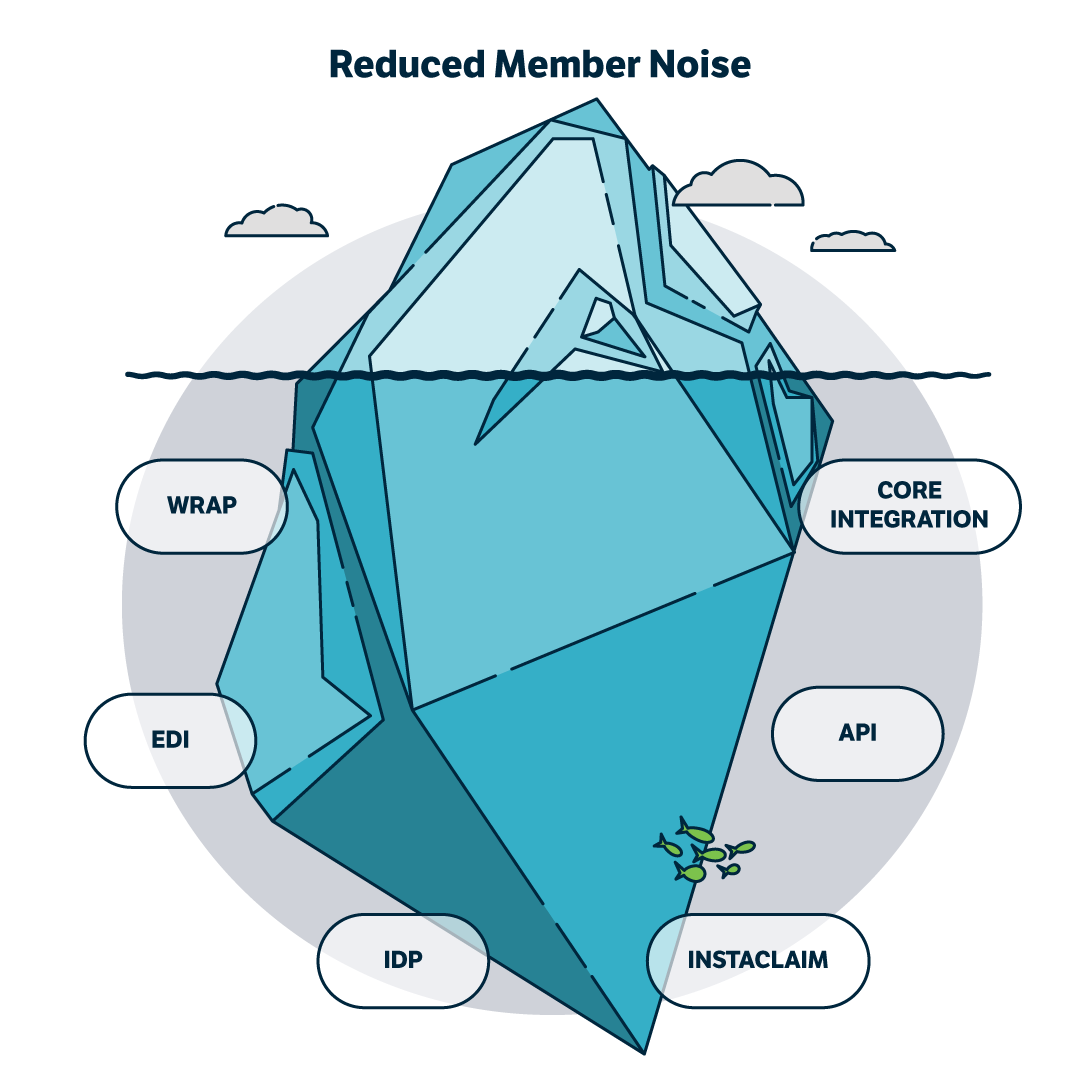

Web-Based Robotic Automated Processing – WRAP uses custom-programmed software robots to automatically log on to insurance carrier websites to retrieve member coverage verification. Our bots look up the insurance carrier’s website, extract the required information, and update the InsurTrak tracking database — all in fractions of a second, without any human intervention.

WRAP eliminates the need for manual entry, reduces errors, saves time, and further ensures borrower information is up to date in real time.

IVR & VeriTrak – In addition to our staffed call center, we have an Interactive Voice response (IVR) system that can respond to and resolve over 35% of all inbound calls, and VeriTrak, an automated prioritization and routing system for the most efficient outbound verifications to insurance carriers.

Texting & Emails – Multiple email touchpoints are included in our borrower notice cycle. Two to three emails are sent at different points in the cycle with direct links to MyLoanInsurance.com. Borrowers can also reply with an image of their information. Our email process has significantly increased borrower response rates, resulting in total notices down 26% and final notices down 33%.

You can also opt in for text notices to reach your borrowers right where they are — on their mobile devices. After borrowers receive a text notification, they can text right back with an image of their insurance or quickly click through to MyLoanInsurance.com. We handle all the details for you, and there’s never an extra charge, now or later.

MyLoan Borrower Website – State National makes it easy for borrowers to obtain information they need, whenever and wherever they need it, through MyLoanInsurance.com. Unlike sites designed specifically for a lender’s staff, MyLoanInsurance.com is customized to the needs of borrowers. The site is also privately labeled with a lender’s brand, reinforcing your relationship with borrowers.

Pulling real-time data from InsurTrak, MyLoanInsurance.com gives every visitor to this password-protected site the ability to submit insurance information (via form or upload), view a dynamic timeline of all transactions, and clearly see periods of insurance coverage, including any lapses and when notices were sent.

The site also features a library of brief animated videos that help borrowers comply with their specific requirements (the proper video is queued based on login) and understand the process and ramifications.

Borrower Videos – We provide impairment-specific micro videos to explain to each borrower why they received a communication and how they can rectify the situation.

InstaClaim – Our exclusive AI-based InstaClaim technology processes and pays some claim types automatically — in under 10 seconds. No other provider is able to offer this kind of speed or automation.

Core Processor Integration – Our technology fully integrates with leading core processors to simplify and automate billing transactions.