Blog

Innovation Strategies for Credit Union Success

May 23, 2024

Embracing Innovation: A Strategic Imperative for Credit Unions

In the rapidly evolving world of financial services, credit unions stand at a unique crossroads. Among the surge of fintechs and neobanks, these community-oriented institutions are navigating the challenges of a crowded market while trying to embrace the opportunities innovation presents.

Filene Research Institute is a credit union-focused “think and do tank” whose research is designed to address credit unions’ top challenges. The organization’s recent report, Innovation Matters: Creating Competitive Growth in Credit Unions, offers a deep dive into how credit unions can leverage innovation to enhance their growth and impact. As a Filene Center of Excellence (CoE) partner, State National is excited to share these insights to help our credit union partners excel as industry leaders.

The Dawn of Disruption

The financial services sector has witnessed a seismic shift over the past decade, driven by the entry of disruptive new players. These innovators have reshaped the landscape by emphasizing digital and mobile access, utilizing data to personalize products, and experimenting with new delivery methods. Amidst this transformation, credit unions are finding ways to differentiate themselves through innovation.

Credit unions’ strong community ties and member-focused philosophy provide a solid foundation for adopting innovative practices. However, the path to innovation is cluttered with numerous options and limited resources. The report suggests a scalable model for innovation, focusing on creative solutions to enhance operations and member services.

The Building Blocks of Innovation

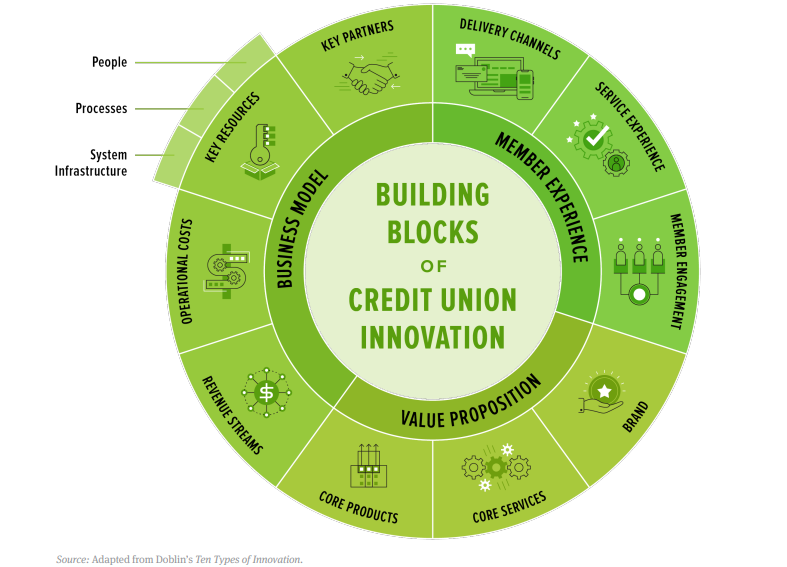

The concept of innovation goes beyond technological advancements — it involves a broad spectrum of changes. Filene’s report outlines three primary categories of innovation for credit unions:

- Business Model Blocks: This involves rethinking internal operations, partnerships, resource allocation, and financial strategies to meet evolving member needs.

- Value Proposition Blocks: Innovating around brand and core products and services to stand out in a competitive market.

- Member Experience Blocks: Enhancing the ways members interact with their credit union through improved service delivery channels, engagement practices, and service experiences.

Social Innovation: Addressing Community Needs

Innovation is not only a business or technological endeavor, it’s also a social one. Credit unions have a history that came from the concerns of communities who needed assistance to fully participate in the economy. The concept of social innovation focuses on creating solutions to social challenges, leveraging credit unions’ unique position to drive economic inclusion, community partnerships, and microfinance initiatives.

Combining Business and Social Innovation

The bottom line of Filene’s report lies in the potential of credit unions combining business and social innovation. This synergy can push credit unions of all sizes toward achieving remarkable community impact, economic inclusion, and broader access to financial services. By integrating innovative practices across various dimensions, credit unions can unlock new growth avenues and solidify their competitive edge.

A Roadmap for the Future

As the financial sector continues to evolve, credit unions must adapt and innovate. This Filene report offers a strategic framework for navigating these complexities, providing credit unions with an opportunity to redefine their roles. By adopting this innovative framework, credit unions can enhance member experiences, achieve lasting community impact, and thrive in a competitive environment.

What Matters to You Matters to Us

Through investing in organizations like Filene, State National further supports the credit union mission and helps our partners benefit from the latest insights into solutions to their industry’s unique challenges.

This collaboration also gives us access to original research to better focus future CPI advancements and technology innovations to benefit our credit union partners. We are proud to have provided sponsorship for research in three of Filene’s Centers of Excellence: Emerging Technology, Innovation & Incubation, and our current CoE partnership, The Credit Union of the Future.

Subscribe to the SNC Spotlight for upcoming original research from Filene’s The Credit Union of the Future CoE!